Value-Add Real Estate

Value-Add Real Estate

What is Value-Add Real Estate?

Value-add real estate, also known as value-oriented real estate, is any commercial property with existing income but also significant opportunities for improvement via operational enhancements, market repositioning or redevelopment. In other words, value-add properties are those that have some income but are not yet at their maximum income potential.

The basic strategy behind value-add real estate investments is to increase the income of a property while the total value of the property appreciates simultaneously.

Because value-add real estate generates income, it has significant opportunity for improvements. It presents a moderate-risk approach for CRE investors who are looking for stable income and capital appreciation. When you invest in the right properties, value-add real estate has the potential to provide durable in-place income.

Risk & Reward

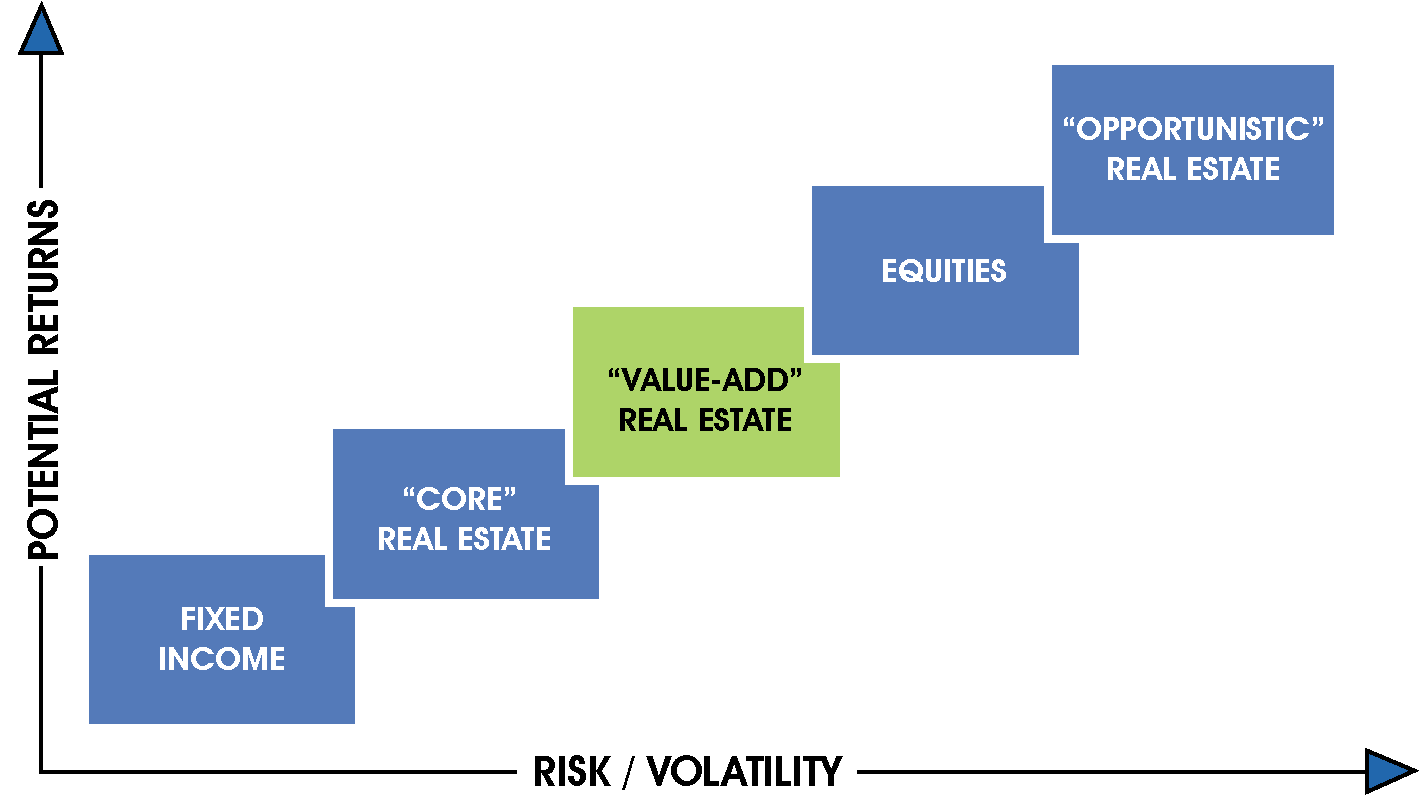

Value-Add Real Estate falls within the middle of the main real estate investment categories regarding Risk/Reward.

- Core: Acquire stabilized, mature assets, keep them nearly the same, and sell them in the future.

- Core-Plus: Do something similar, but make more changes, such as light improvements to the units or the furnishings.

- Value-Add: Acquire a property, complete significant renovations / improvements to the building, improve management and operations, lease up, and then sell it in the future.

- Opportunistic: Develop a new property from the ground up or acquire an existing one and “redevelop” it into a different type (e.g., shopping center to industrial complex), and sell it in the future.

Approaches to Value-Add Real Estate

Value-Add Real Estate can be approached in a variety of ways. Below is a list of the ways we often see Value-Add real estate approached:

- Lease Structure Improvements

- Expenses Rebidding

- Value Engineering

- Deferred Maintenance

- Repositioning Renovations

- Land Entitlements – Highest & Best Use

- Improve Tenant Quality / Credit Worthiness

- Story Telling

- Functional Obsolescence

- Capital Planning

- Responsive Management & Maintenance (Tenant Response)

- Property Branding & Exposure

- Government Grants & Participation

Interested in learning more about each of these approaches? Give our Value-Add Team a call, or request the Value-Add Package here for descriptions of each Value-Add Approach.

The Value-Add Process

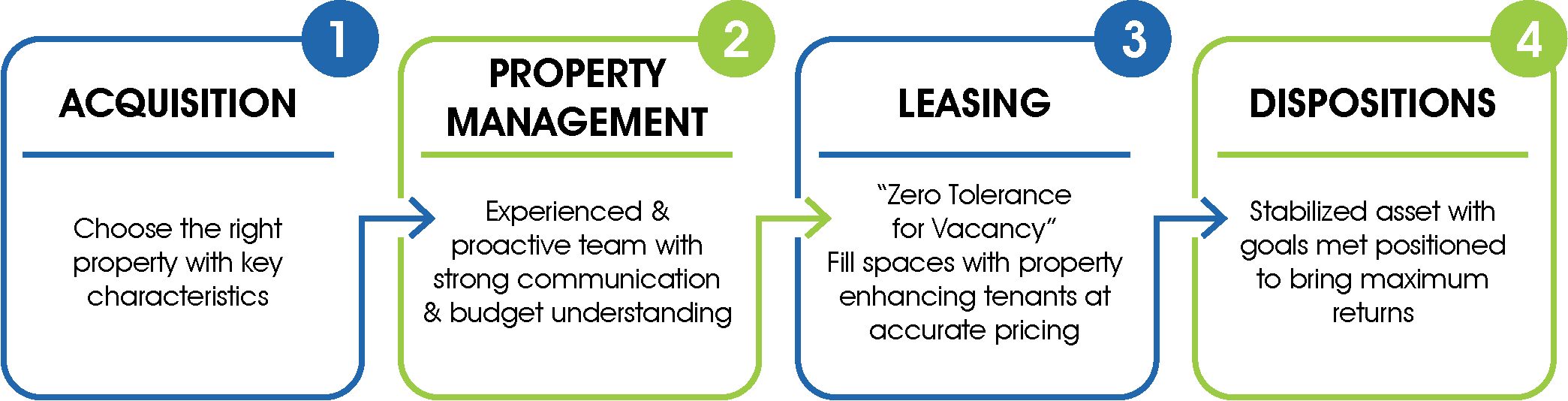

The four main tenets of successful value-add investments are Acquisition, Property Management, Leasing, and Disposition.

- Acquisition: Proper evaluation of value-add opportunities during the due diligence and acquisition phases are the keys to success. Successful value-add exits start with identifying properties in great locations that have strongfundamentals and potential upside value that has not been fully realized. The most prevalent reasons for which upside value has not been realized in value-add opportunities are lack of adequate property management, significant deferred maintenance, high rates of vacancy, and other issues that may plague the asset such as inefficient mechanical, electrical, and plumbing infrastructure that make it difficult to bring in new tenants at reasonable rates of tenant improvement allowances.

- Property Management: Adequate and capable property management is an extremely important facet of achieving success in value-add real estate. It is imperative that whoever is leading the acquisition efforts also have a nimble and focused property management team that can assist from the early phases of due diligence all the way through to the disposition of the asset once goals for the asset have been achieved. Our property management team at First Capital Property Group manages nearly 3 million square feet of commercial real estate, in addition we employ a full-time quick response facilities maintenance team that’s nimble and able to very quickly respond to the myriads of issues that are encountered when operating value-add assets whether before, during, or after hours. Quick responses to issues that arise can oftentimes be the difference in preventing small issues from escalating into more serious and expensive issues that affect the operation of building systems and ultimately tenant satisfaction, both of which can affect the bottom line. Successful property management can also in many cases help improve tenant satisfaction, rent collections, and tenant retention, all cornerstones to improved asset valuations. Finally, property management is also responsible for efficient management of all construction projects/building improvements both interior and exterior, therefore having a talented, competent, and capable property management team that successfully usher projects through on budget is an extremely important aspect of the value-add process.

- Leasing: The number one rule of our value-add team regarding leasing is “Zero Tolerance for Vacancy”! Aggressive marketing of our client’s buildings, and diligent pursuit of new tenants, are the main driving principles of successful value-add opportunities. Our leasing team has decades of experience in negotiating commercial leases and we study the markets closely to ensure that available space in our client’s properties is priced right, properly positioned, and competitive in whichever marketplace in which the asset is located. Once prospective tenants are identified, our leasing team thoroughly vets and evaluates those prospects to ensure that there is minimal risk for turnover. Our leasing team is also experts in finding the right balance between tenant and landlord expectations without sacrificing the long-term goals of our clients which often include maintaining a growing rental rate environment on the way to target rents, which is often critical for things like cash-out refinancing, negotiating with other tenants, and ultimately ensuring the building is properly positioned for disposition.

- Dispositions: Once we have achieved the goals of stabilizing and repositioning the asset, we then thoroughly evaluate the market for potential opportunities to begin the disposition process. By this time, we have successfully achieved the goals that we mentioned in the “Acquisition” section, those goals being improved and efficient property management, minimal deferred maintenance, low to no vacancy, stabilized rent rolls, and overall improved condition and performance of the asset. In our experience, once the goals for the asset have been achieved there is a typically significant increase in interest from buyers who seek well positioned, stabilized assets that are primed for future growth, and those buyers are often willing to pay top of market in whatever class of real estate the asset is positioned.

Value-Add Real Estate Case Studies

The Historic Metcalf Building

10-Story, 39,256 RSF Historic Office & Retail Building

Approaches Used:

- Capital Planning

- Property Branding & Exposure

- Government Grants & Participation

- Lease Structure Improvements

- Deferred Maintenance

- Improved Tenant Creditworthiness

- Responsive Management & Maintenance

Summary Narrative:

The FCPG Team was brought on by the owner to reposition the Historic Metcalf Building, an outdated and neglected relic in need of significant refurbishment. We crafted a rebranding strategy, sought government grants, prioritized capital repairs, and told the marketplace the story of a classic building being reborn in the downtown core. By acting as space planner, project manager, and tenant coordinator we demonstrated to the tenants the Ownership’s commitment to the building. Our team leased all 10 floors to high-credit tenants on strong leases, completed major capital repairs, and ultimately found a premium buyer before fully going to market. The new buyers were so impressed with our team, they retained us for the property and asked us to handle two other large Florida projects.

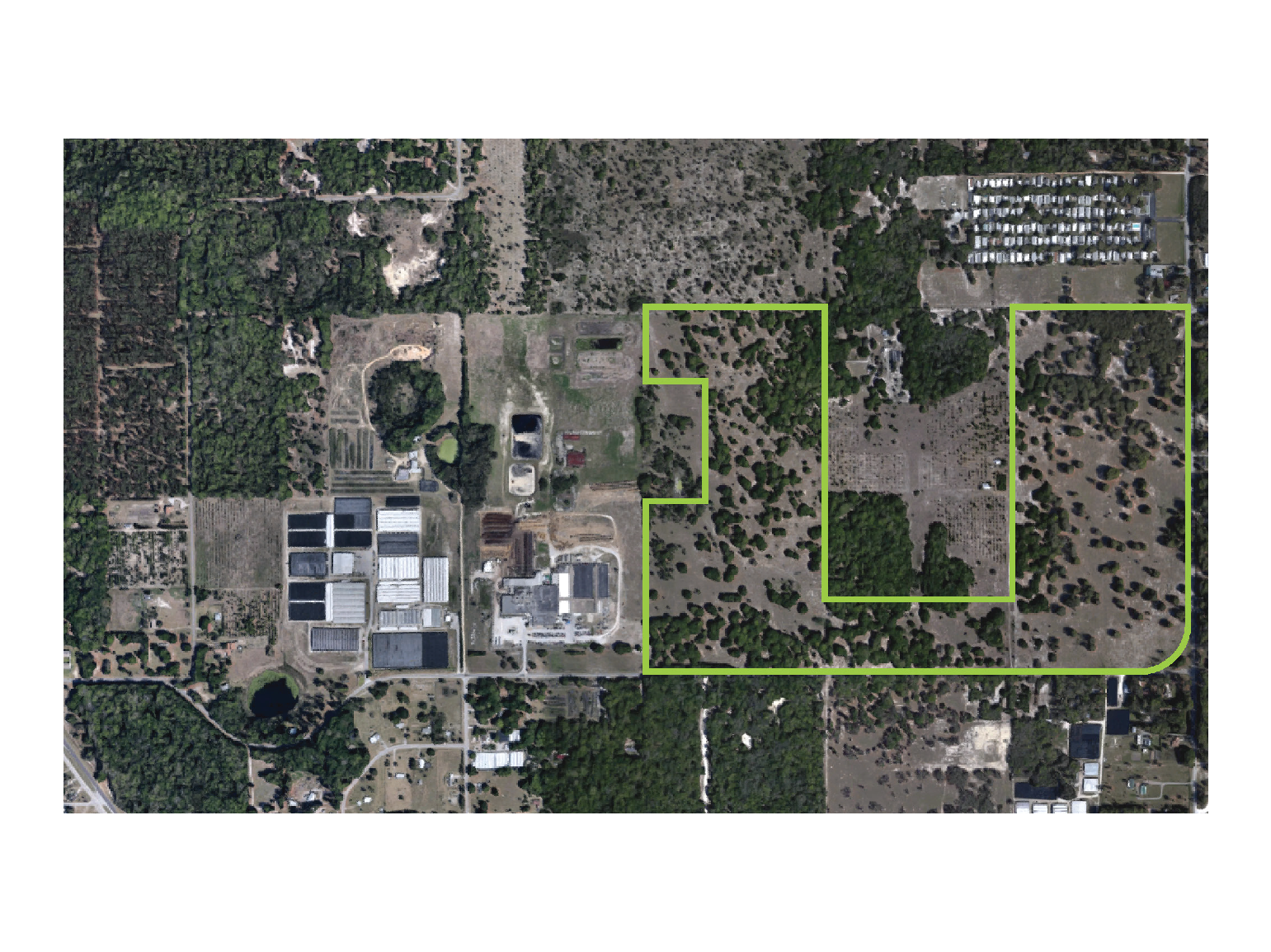

Orlando Beltway Associates

110 Acres Agricultural Land

Approaches Used:

- Land Entitlements

- Highest & Best Use

- Government Grants & Participation

- Capital Planning

- Story Telling

Summary Narrative:

The FCPG Team was involved with the management and positioning of the land since its acquisition in the late 1980s, but the buyer’s knew it would be a long term hold. When FCPG learned of potential new expressway plans in the 2010, we knew it was time to start taking proactive steps. We worked with city officials and land planners to determine how to re-entitle the property from a county agricultural density to a city annexed employment and medium density residential zoning. This changed the residential entitlement from 1 home per 5 acres to 5 homes per 1 acre; a dramatic increase in value. We also walked the ownership through a partial eminent domain proceeding with help from an outside legal team. We then sold the employment zoned portion to a large hospital chain and the residential portion to the large national home builder.

Welaka

28,000 RSF Historic Office & Retail Building

Approaches Used:

- Capital Planning

- Responsive Management & Maintenance

- Property Branding & Exposure

- Government Grants & Participation

- Lease Structure Improvements

- Deferred Maintenance

- Improved Tenant Creditworthiness

Summary Narrative:

The FCPG Team was brought on initially in 1996 to reposition the property for an international owner. After a full renovation we leased the property to two government tenants on long-term leases. 10 years later, we again revitalized and rebranded the historic building using grant help from the local government. We sold the property for our original client for a healthy gain in 2017 and was then retained by the new buyer to further improve and position the property along with an improving marketplace. We improve the tenant mix and lease structure, brought the property back to 100% occupancy over the next 18 months and helped our client to sell for a larger than expected return. Through our 21 year history with the property we kept our focus on positive relationships with Owners, Vendors, and Tenants that benefited all parties over two decades.

New York Plaza

33,365 RSF Historic Office & Retail Building

Approaches Used:

- Capital Planning

- Responsive Management & Maintenance

- Property Branding & Exposure

- Government Grants & Participation

- Lease Structure Improvements

- Deferred Maintenance

- Improved Tenant Creditworthiness

Summary Narrative:

The FCPG Team was brought on by owner to replace the existing management and leasing company. After onboarding, FCPG took charge with capital planning to payoff a note balloon and address deferred maintenance issues, converted to new leases, and rebranded the property in the marketplace. After winning multiple grants and working with the local municipality, FCPG was able to take the property from 30% occupied to 94% occupied at time of sale. FCPG took the property from near default, to a 60% gain upon exit for the ownership.

Oak Ridge Plaza

75,701 RSF Retail Center

Approaches Used:

- Repositioning Renovations

- Value Engineering

- Property Branding & Exposure

Summary Narrative:

The FCPG Team was tasked by the building ownership to prepare the property for sale. Our team advised the owner on a number of renovations that would help retain and improve the tenant mix. Through value engineering, the renovations and rebranding of the property were kept on budget, led to increased occupancy, tenant stability, and NOI, and allowed the ownership to net over $2 million in increased value upon exit from the property.

924 & 934 Magnolia

27,276 RSF Office Buildings

Approaches Used:

- Land Entitlements – Highest & Best Use

- Story-Telling

- Property Branding & Exposure

Summary Narrative:

The FCPG Team identified a building for sale in Downtown Orlando that they recognized as under improved and undervalued. After investigating for our client, we determined that with the right exposure and marketplace story-telling that the property’s highest and best use would be a complete re-development in line with the maximum permitted entitlements. The property was purchased at the basis of the under improved property, and repositioned to be valued for nearly twice as much, based on the Highest and Best Use Entitlements.